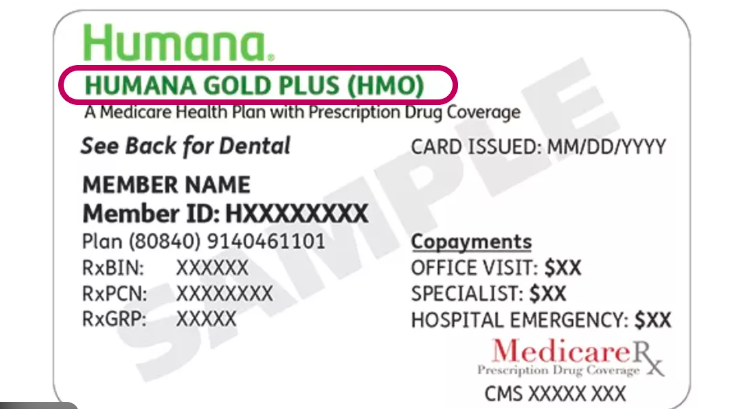

Humana Gold Plus is a Medicare Advantage (Part C) HMO plan offered by Humana Inc.. It combines:

- Medicare Part A (hospital)

- Medicare Part B (medical)

- Usually Part D (prescription drugs)

- Extra benefits not covered by Original Medicare

It’s mainly designed for seniors who want low premiums and coordinated care through a network of providers.

Key Features of Humana Gold Plus

1. HMO Plan Structure

- Must use in-network doctors and hospitals

- Primary care physician (PCP) required

- Referrals needed for specialists (usually)

- Emergency care covered anywhere

👉 This keeps costs lower but limits flexibility.

2. Prescription Drug Coverage (Usually Included)

Most Gold Plus plans include:

- Tiered drug pricing

- Mail-order pharmacy options

- Preferred pharmacy discounts

(Some plans may vary by state.)

3. Extra Benefits (Beyond Medicare)

Many Humana Gold Plus plans offer:

- Dental coverage

- Vision exams and glasses

- Hearing exams and aids

- Fitness programs

- Telehealth services

- Transportation to medical appointments

- Over-the-counter health allowances

These extras are why many seniors choose Medicare Advantage over Original Medicare.

4. Costs (Typical Range)

Costs vary by location, but generally:

- Monthly premium: $0–$50 (many $0 plans)

- Primary care visits: Low copay

- Specialist visits: Higher copay

- Annual out-of-pocket maximum: Required limit (protects spending)

You must still pay the Medicare Part B premium.

Pros of Humana Gold Plus

✅ Very low or $0 monthly premiums

✅ Extra benefits not included in Original Medicare

✅ Built-in prescription drug coverage

✅ Preventive care coverage

✅ Spending cap protection

✅ Coordinated care through PCP

Many users choose it mainly for affordability + extra benefits.

Cons of Humana Gold Plus

❌ Limited provider network

❌ Referrals needed for specialists

❌ Not ideal for frequent travelers

❌ Coverage varies heavily by region

❌ Prior authorization may be required for some procedures

HMO structure is the biggest downside for people who want flexibility.

Who Should Choose Humana Gold Plus?

Best For:

✔ Budget-conscious seniors

✔ People comfortable using network providers

✔ Those wanting dental/vision benefits included

✔ Individuals who prefer coordinated care

Not Ideal For:

✘ People who travel often

✘ Those wanting nationwide doctor choice

✘ Patients needing specialized care outside networks

Customer Satisfaction & Ratings

Humana Medicare Advantage plans typically receive:

- Strong Medicare star ratings (varies by region)

- Good preventive care programs

- Competitive pricing vs other insurers

However, like most HMOs, complaints often involve:

- Network restrictions

- Authorization delays

- Coverage approvals

Humana Gold Plus vs Original Medicare

| Feature | Humana Gold Plus | Original Medicare |

|---|---|---|

| Premium | Often $0 | Part B premium required |

| Doctor Choice | Network only | Nationwide |

| Drug Coverage | Usually included | Must buy separately |

| Extra Benefits | Yes | No |

| Out-of-Pocket Limit | Yes | No |

Final Verdict

Humana Gold Plus is one of the strongest low-cost Medicare Advantage options, especially for seniors who want:

- predictable healthcare costs

- extra benefits

- simple coverage management

But the network restrictions and referral requirements make it less suitable for people needing maximum flexibility.

⭐ Overall rating: 4.2 / 5 (strong value, limited flexibility)