Blue Cross Blue Shield (BCBS) is one of the most recognized health insurance providers in the United States, offering coverage to millions of Americans through a network of independent companies. Known for its extensive provider network, flexible plan options, and nationwide coverage, BCBS is often a top choice for individuals, families, seniors, and employers.

This comprehensive review explains how Blue Cross Blue Shield insurance works, coverage options, costs, pros and cons, and whether it’s the right health insurance provider for your needs.

Understanding Blue Cross Blue Shield Insurance

Blue Cross Blue Shield is not a single insurance company but a federation of independently operated health insurance organizations that provide coverage across all 50 states. Each regional company operates locally while sharing the BCBS brand and nationwide provider network.

This structure allows BCBS to offer:

- Broad healthcare provider access

- Local customer support

- Nationwide coverage options

- Flexible plan types

BCBS covers more than 100 million Americans, making it one of the largest health insurance networks in the country.

Types of Blue Cross Blue Shield Health Insurance Plans

BCBS offers a wide range of plans tailored to different healthcare needs and budgets.

Individual and Family Plans

These plans are available through state health insurance marketplaces or directly from BCBS companies.

Features:

- Preventive care coverage

- Prescription drug benefits

- Hospital and doctor visits

- Mental health services

- Emergency care coverage

These plans often comply with Affordable Care Act (ACA) requirements.

Employer-Sponsored Health Insurance

Many employers offer BCBS plans as part of workplace benefits.

Benefits:

- Lower premiums through group pricing

- Comprehensive medical coverage

- Preventive services

- Wellness programs

Employer plans typically provide broader coverage at lower costs.

Medicare Plans

BCBS offers several Medicare options for seniors:

Medicare Advantage (Part C)

- All-in-one coverage including hospital and medical services

- Often includes prescription drug coverage

- Additional benefits like dental or vision

Medicare Supplement (Medigap)

- Helps pay out-of-pocket costs not covered by Medicare

Medicare Part D

- Prescription drug coverage

Medicaid Plans

In some states, BCBS offers Medicaid coverage for low-income individuals and families who qualify under state guidelines.

What Does Blue Cross Blue Shield Insurance Cover?

Coverage depends on the specific plan, but most BCBS policies include essential healthcare services.

Preventive Care

- Annual checkups

- Vaccinations

- Screenings and tests

- Wellness visits

Preventive care is often covered at no additional cost.

Doctor and Specialist Visits

BCBS covers primary care visits and specialist consultations within the provider network.

Hospital Services

- Emergency care

- Surgery

- Inpatient hospital stays

- Outpatient procedures

Prescription Drug Coverage

Many plans include coverage for generic and brand-name medications.

Mental Health Services

Coverage often includes therapy sessions, counseling, and psychiatric care.

Maternity and Pediatric Care

Family plans usually cover prenatal care, childbirth services, and child healthcare.

Blue Cross Blue Shield Provider Network

One of BCBS’s strongest advantages is its large provider network.

Network Benefits:

- Access to thousands of hospitals and doctors

- Nationwide coverage options

- Easy specialist referrals

- Strong rural healthcare access

Many BCBS plans also participate in the BlueCard® program, allowing members to receive care outside their home state.

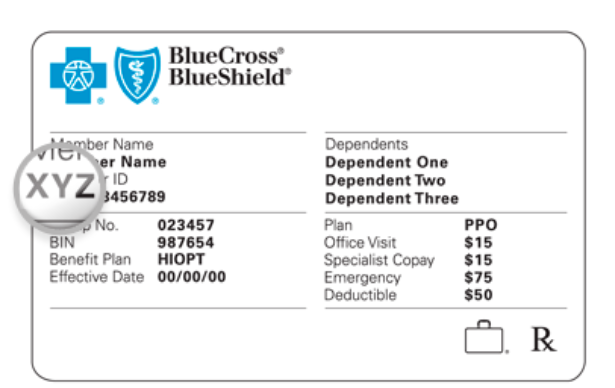

Blue Cross Blue Shield Costs

Health insurance costs vary widely depending on plan type, location, age, and coverage level.

Factors Affecting Premiums

- Location and state regulations

- Age and health status

- Plan tier (Bronze, Silver, Gold, Platinum)

- Deductible and out-of-pocket limits

- Tobacco use

Average Cost Estimates

Typical monthly premiums may include:

- Individual plans: $350–$900 per month

- Family plans: $900–$2,000+ per month

Employer plans often cost significantly less due to shared premium contributions.

Plan Types Offered by Blue Cross Blue Shield

BCBS offers several plan structures to fit different needs.

Health Maintenance Organization (HMO)

- Lower premiums

- Requires primary care physician

- Limited network coverage

Preferred Provider Organization (PPO)

- More provider flexibility

- Higher premiums

- No referral required for specialists

Exclusive Provider Organization (EPO)

- No out-of-network coverage except emergencies

- Lower costs than PPO plans

High-Deductible Health Plans (HDHP)

- Lower premiums

- Higher deductibles

- Compatible with Health Savings Accounts (HSAs)

Advantages of Blue Cross Blue Shield Insurance

Extensive Provider Network

One of the largest healthcare networks in the U.S., providing easy access to doctors and hospitals.

Nationwide Coverage

Members can receive care across states through participating providers.

Flexible Plan Options

Offers multiple plan types for different budgets and healthcare needs.

Strong Financial Stability

BCBS companies generally maintain strong financial ratings.

Preventive Care Focus

Emphasis on early detection and wellness services.

Disadvantages of Blue Cross Blue Shield Insurance

Costs Can Be High

Premiums and out-of-pocket costs may be higher than some competitors.

Coverage Varies by Region

Benefits and pricing differ depending on your state.

Complex Plan Choices

The wide range of options can make plan selection confusing.

Claims and Customer Service Vary

Customer experience depends on the local BCBS provider.

Customer Experience and Claims Process

Customer experience varies because BCBS operates through regional companies. However, most providers offer:

- Online member portals

- Mobile apps for claims and billing

- Telehealth services

- 24/7 customer support

Claims are typically handled efficiently, especially for in-network services.

Who Should Consider Blue Cross Blue Shield?

BCBS may be ideal for:

- Individuals wanting nationwide coverage

- Families needing broad provider access

- Seniors seeking Medicare plans

- People who travel frequently

- Individuals wanting reliable healthcare networks

It may not be ideal for those seeking the lowest-cost insurance or very simple plan options.

How to Get a Blue Cross Blue Shield Insurance Quote

You can obtain a BCBS quote through:

- Your state’s health insurance marketplace

- A local BCBS company website

- Licensed insurance agents

- Employer-sponsored enrollment

You’ll typically need personal information, household details, and coverage preferences.

Is Blue Cross Blue Shield Insurance Worth It?

Blue Cross Blue Shield remains one of the most trusted health insurance providers in the United States due to its large network, flexible coverage options, and strong industry reputation. While costs may be higher than some competitors, the broad provider access and nationwide coverage make it a valuable choice for many individuals and families.

For those who prioritize reliable healthcare access and comprehensive coverage, BCBS is often a strong long-term health insurance solution.